“Savings” are usually the portion of your income that is accessible to at any time. They are usually put in the safest place or product and when left to accumulate lay idle without generating additional income. In fact as time progresses, the value of such money could fall due to multiple factors such as inflation and other macroeconomic situations. “Investing”, on the other hand, entails allocating your money into financial products that generate risk-adjusted return. It is generally advisable to set aside a certain portion of income that will not be needed for many years. Investing results in higher exposure to risk but it also yields greater returns when left alone long enough.

Mutual funds are essentially medium to long term investments. Hence, short-term abnormal profits will not be sustainable in the long run, and although there is never a guarantee of a minimum return in the medium to long run, mutual funds tend to outperform most other avenues of investments as Mutual Funds are run by professional managers.

Past track record of the fund is important; however it is not as important as you may think, especially in the short term. As, with any investment, past performance alone does not guarantee future returns. Over the long term, the fund performance depends on factors mentioned above.

One time charges-

Recurring Charges (Ongoing expenses/Fund Running Expenses) –

Is a category of funds that invest in a diverse mix of securities that cut across sectors.

However invest in only specific sectors. For example, a banking sector fund will invest in only shares of banking companies.

Invest in line with an investment theme. For example, an infrastructure thematic fund might invest in shares of companies that are into infrastructure construction, infrastructure toll-collection, cement, steel, telecom, power etc.

Invest in only treasury bills and government securities, which do not have a credit risk.

Invest in a mix of government and non-government debt securities. In selecting corporate bond funds, one needs to be cautious in the selection of funds particularly on the quality and the rating of the borrowers.

Are a kind of debt fund where the investment portfolio is closely aligned to the maturity of the scheme.

Are a variant of debt schemes that invest only in ultra short duration debt securities.

Balance fund aim to provide capital appreciation with steady income by investing in a portfolio of stocks and bonds. It can be either a fixed percentage or can vary as per market cycles.

You should consider investing in direct equities if you have the time to actively monitor and research stocks, you have a reasonable knowledge about the financial markets and you have the patience to bear market volatility. Mutual funds are specifically designed as well diversified investment portfolios. Professional money managers ensure rigorous investment discipline to manage these funds. The fund managers are generally able to devote more time and resources to monitoring investments, than an individual could, and tend to react less to short term investor sentiment.

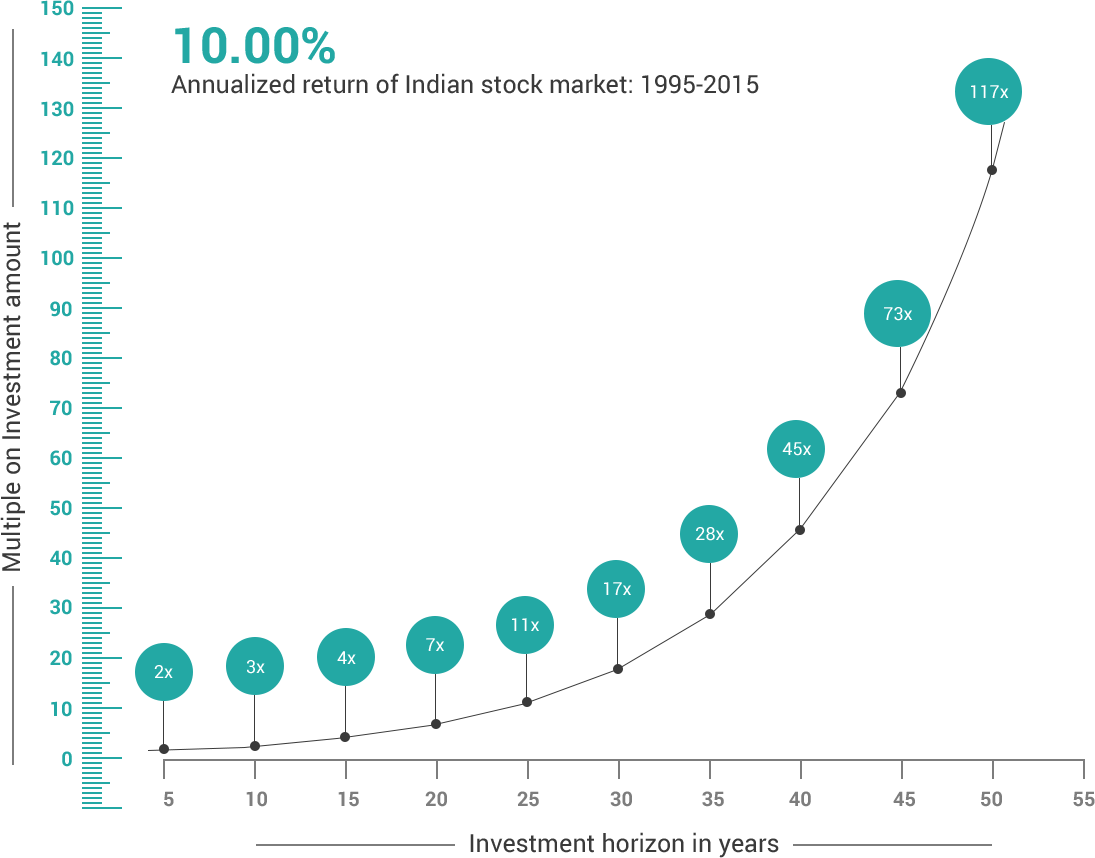

Indian stock markets have generated 11.25% annualized return for its investors in the last 20 years. In contrast an investor would have earned only a meager 4-5% return post tax on fixed deposits. The difference in performance captures the essence of investment philosophies that lie on either sides of the risk-return continuum. While a fixed deposit can be considered as one of the safest ways to deploy one’s hard earned wealth, it surely is not the most productive one. There also exist Fixed Income products that provide same level of safety as a fixed deposit as well as a higher return such as State Govt and PSU perpetual bonds offering up to 11-12% return.

Investing is only the first step. Once invested you need to keep track of your performance. While keeping an eye on your portfolio performance do not get influenced or panic by its short term performance. Technology coupled with our comprehensive and easy to interpret report will help you stay on top of it. We provide you with 24×7 online accesses to your portfolio.

Absolutely. The data provided is only used to assess your risk profile and to recommend investments. Our online investment platform is in association with NSE( National Stock Exchange) and it is equipped with the best online safety and protection tools that ensure that all your investment transactions always take place in a reliable and secure manner.

With Divitas, you can invest your money through both the online and offline routes

Invest Online

Invest Offline

Sound financial advice is based on more than just the knowledge of markets & financial products. At Divitas, we take time to learn about your financial planning needs, risk appetite and liquidity requirements. After understanding your goals we begin to develop a meaningful strategy for your investments. We have access to a broad range of experts because of our size which helps in ensuring that you get the professional advice you require to achieve your investment objective. Lastly, we are neutral in our advice and not incentivized to suggest a single fund house.

We review and send out our clients’ investment reports each month with a short summary along with our recommendations, if any. We study all macroeconomic dynamics along with new regulations and their impact on our clients’ individual portfolios. We act and communicate proactively in case our view on a particular asset class changes.

With Divitas, you can invest your money through both the online and offline routes

Wealth creation is a long term process and it requires a systematic approach along with regular portfolio review. We at Divitas capital believe in developing long term relationships based on mutual trust. Whether it is retirement or any other financial goal, it requires dynamic asset allocation as with each new set of circumstances come new objectives. These transitions do alter the risk profiles and the portfolio needs to be aligned accordingly.

The requirements applicable to an NRI will also apply to a PIO. However, additionally, he or she will need to submit a certified true copy of the PIO Card.

Yes. In addition to the certified true copy of the passport, certified true copy of the overseas address and permanent address will also be required. If any of the documents (including attestations/ certifications) towards proof of identity or address is in a foreign language, they have to be translated to English for submission. The documents can be attested, by the Consulate office or overseas branches of scheduled commercial banks registered in India.

The soft copy of the KYC form is available on our website. You may also approach your relationship manager for a form or else you can download the same from this link. The same duly completed along with a recent photograph, the necessary attested documents such as PAN card, passport, identity and address proof can be submitted or mailed to our representative who can complete the KYC formalities for you.

Yes. The permanent residency status will be granted for a period of 10 years initially with multiple entry facility. Foreign investors bringing in at least Rs 10 crore capital will be eligible for residency status, easier visa regime and employment for family members among other benefits under a new policy (scheme) approved by the Cabinet. Under the scheme, suitable provisions will be incorporated in the visa manual to provide for the grant of permanent residency status to foreign investors. Permanent residency status will be granted for a period of 10 years with multiple entries. This can be reviewed for another 10 years if the holder has not come to adverse notice. The scheme will be applicable only to foreign investors fulfilling the prescribed eligibility conditions, his/her spouse and dependents. In order to avail this scheme, the foreign investor will have to invest a minimum of Rs 10 crore to be brought within 18 months or Rs 25 crore to be brought within 36 months. Further, the foreign investment should result in generating employment to at least 20 resident Indians every financial year. The status will serve as a multiple entry visa without any stay stipulation and holders will be exempted from the registration requirements. These status holders will be allowed to purchase one residential property for dwelling purpose. The spouse/ dependents will be allowed to take up employment in the private sector (in relaxation to salary stipulations for Employment Visa) and undertake studies in India.

Taxability of income in India depends upon residential status. Foreign nationals resident in India are liable to pay tax on the taxable income as in case of other resident assessees. Foreign nationals who are non-residents are liable to pay tax at special rates on income from dividends, interest and capital gains from units of mutual funds, bonds, shares, Global Depository Receipts, royalty or fees for technical services.

QFI will be distinct from FII and non-resident Indians (NRI). A QFI can, for instance, be a foreign individual investor in China or any other country, who can buy into stocks of any listed company in India. All a QFI needs is to fulfill a few requirements like the Know Your Customer (KYC) norms. While an FII is required to go through a more complicated route of approvals, SEBI registration and has to pay a registration fee as well.

Double Tax Avoidance Agreement or DTAA is an agreement between two countries to help avoid taxation of an income in both the countries. India has double taxation agreements, which override the Indian law, with virtually all its major trading partners. Meaning, expats are not liable to pay taxes in both countries of residence. Please consult a tax specialist to determine if ones home country and India have such an agreement in place, and to determine in which country one should file taxes in.

The taxability of income of a person depends primarily upon his ‘residential status’ If a foreign citizen is a resident in India, all incomes received, accrued or arisen to him in India or abroad shall be subject to tax in India. If a foreign citizen is not a resident in India, only incomes that are received, accrued or arisen to him in India, shall be taxable.

Now the foreign nationals and business entities, called Qualified Foreign Investors (QFIs), can invest in India without any hassles. QFIs can invest directly into Indian mutual funds and stocks of the listed companies. Earlier only FIIs, their sub-accounts and NRIs were allowed to directly invest in Indian markets. SEBI has prescribed the requirements and procedure for account opening by QFI along with manner of operations thereof. QFIs shall transact only on delivery based transactions and each transaction shall be cleared & settled on gross basis and they are not allowed to issue any offshore derivatives instruments/ participatory Notes.

Funds where equity holding is more than 65% of the total portfolio are classified as equity funds for taxation. All equity schemes, arbitrage funds, balanced funds (which have 65-75% equity and 25-35% debt) are classified as equity oriented funds from a taxation perspective. If you buy and hold an equity-oriented MF for more than 1 year, long term capital gain on such funds will be nil. However, if you sell the fund before one year you are liable to pay short-term capital gains tax which is 17.768% (including surcharge & cess).

Investors can opt for either the dividend option or a growth option in a mutual fund scheme. If they opt for the growth option, they do not get any dividends. When they sell the fund they earn a capital gain. If they opt for the dividend option, they will receive intermittent dividends at regular intervals plus earn a capital appreciation, when they redeem. Dividend income is tax-free or exempted from tax in the hands of individual/HUF (Hindu Undivided Family) investors in all mutual fund schemes. Dividend Distribution Tax (DDT), which is applicable to non-equity schemes only, is paid by the mutual fund/asset management company.

Liquid funds, income funds, gilt funds, capital protection schemes are classified as debt-oriented schemes for taxation. Units of such non-equity mutual funds held for more than 36 months qualify as long-term capital gains. On such units, long-term capital gains (LTCG) are taxed at 20% with indexation, while short term capital gains on such funds are taxed as per the slab rate of the individual investor.

At the time of Sale of any Asset, Tax is liable to be paid on the Gains earned on the sale of Asset. Such Gains can either be Short Term Capital Gains or Long Capital gains. The classification of short term and long term capital gains and their tax rates is different in case of shares and mutual funds.