Variance as a measure of risk

The standard definition of risk according to modern portfolio theory is the measure of variance (or standard deviation) of the portfolio’s return. In the table below, we can see two portfolios with the same average return, yet the individual returns of portfolio “B” are way more varied than portfolio “A”. This is measured statistically as the standard deviation of returns.

| Returns % |

Portfolio “A” |

Portfolio “B” |

| Year 1 |

8% |

5% |

| Year 2 |

10% |

13% |

| Year 3 |

7% |

-1% |

| Year 4 |

11% |

15% |

| Year 5 |

9% |

13% |

| Average Return |

9% |

9% |

| Standard Deviation |

2% |

6% |

Systematic vs. Unsystematic risk

Unsystematic risk

is simpler to understand. Such type of risks is unique to each of your investments e.g., an investment in a stock or bond of a specific company. This investment will have a specific risk associated with it, specifically the risk associated with the company’s performance and the industry it operates in. It is easy to mitigate this risk by diversifying the portfolio, which basically requires an investor to NOT put all of their “eggs in one basket”.

Systematic risk

is a slightly trickier subject; it basically is the risk that is common across the portfolio. For example if all your investments are in equity funds, then your investments are at risk if there is a flight of liquidity from equity markets. Diversification can help here too, but it is important to understand the nature of systematic risk. Say for example you also invest in fixed income funds to diversify risk. The whole portfolio would be at risk if there is a downturn in the economy and companies struggle with operations and debt obligations, resulting in losses in both the debt and equity portfolio. If you had invested in real estate to further diversify risk; remember that these are all Rupee-denominated investments and inflation can wipe away all your real gains in equity, debt and real estate. The moral here is that systematic risk can never be fully eliminated, only minimized.

Risk from a time perspective

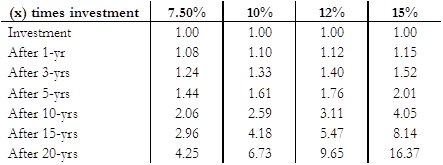

Another perspective on risk is that of time horizon. Different asset classes show different characteristics over different time horizons. For example, equity fund returns may seem very risky from a time perspective of less than a year as compared to fixed deposit of a similar maturity. A one-year fixed deposit will earn you an assured 6-7%, while equity returns can vary from -20% to +20%. But the same equity asset class looked at from a multi-year perspective will give you 12-15% return averaged over a number of years with a high degree of certainty.

Additionally, a time related risk is that of business cycles. During times of an economic boom, stock market returns will show phenomenal growth lulling the investor into a false sense of security that this is the status-quo and things will remain as rosy forever. However, this can change very quickly when the economy endures a prolonged slump and returns can be sluggish for years. These cycles can last for 3-4 years in each phase and dent the investor’s portfolio significantly if she is not aware of what is going on and enters and exits at inopportune times. The best way to avoid such pitfall is to remain vigilant during boom times, diversify risk and exhibit patience during slumps to ride out the bearish cycles to generate healthy returns.

Quantum of risk

Different financial assets have different quantum of risk associated with them. For example a debt instrument may not exhibit any variance in returns as the payments are fixed but carries a risk of default where an investor can lose all of her capital in one go. While an equity portfolio may lose value more often as the returns are a function of its price; it will typically not lose more than 20-25% in the worst of times for a well diversified portfolio. To understand this risk better, an investor should carry out a Value at Risk (VaR) analysis to determine how much her investments could lose in value in the most adverse circumstances.

Managing risk

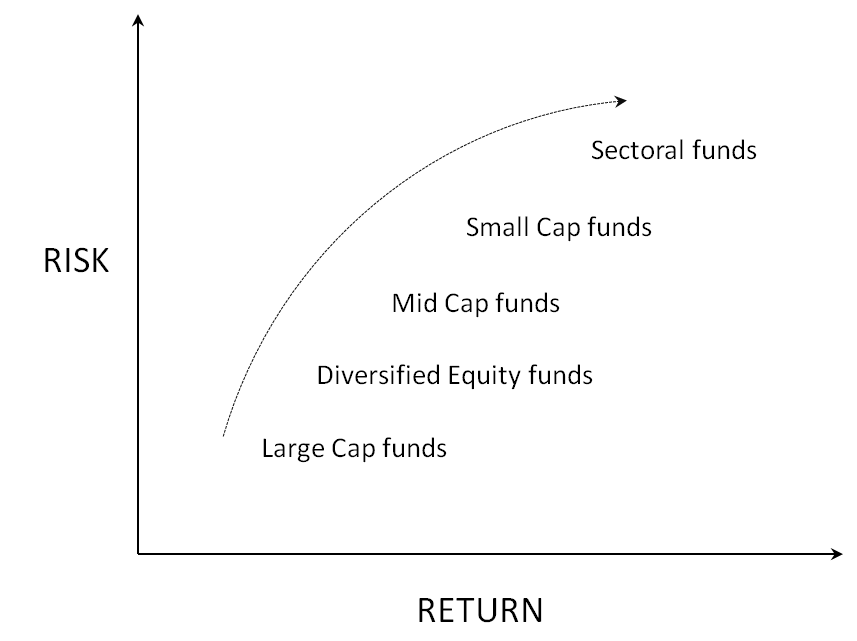

We now have a basic idea of what risk is. There also exists a rough relationship between risk and return; i.e. higher the risk, higher the potential gain/loss.

But what does this signify? More importantly, what does it signify for you as an individual investor? The first step any individual should take before starting to invest is to determine her risk profile. Your risk profile depends majorly upon 2 factors.

The first is, where you are in life, i.e. what is your age and how many financial responsibilities you have, this helps determine how much to invest, where to invest and for how long.

The second is what your risk taking predisposition is, i.e. how conservative or bold you are with your financial investments. This can again be a function of where you are in life but also significantly depend upon your personality type.

To summarize, understanding your risk appetite and goals go a long way in allocating capital prudently while avoiding any major investing pitfalls.

Read More

Recent Comments