Most of clients that I meet have some form of investments that are generally a result of their random visit to the bank or a recommendation by a friend or relative. Needless to say such ad-hoc approach to investing is value dilutive and reduces the worth of your investments over long period of time.

I have observed that people worry a lot about their distant future (read retirement) without actually doing anything about it and generally cite unavailability of information and procrastination as the main reasons.

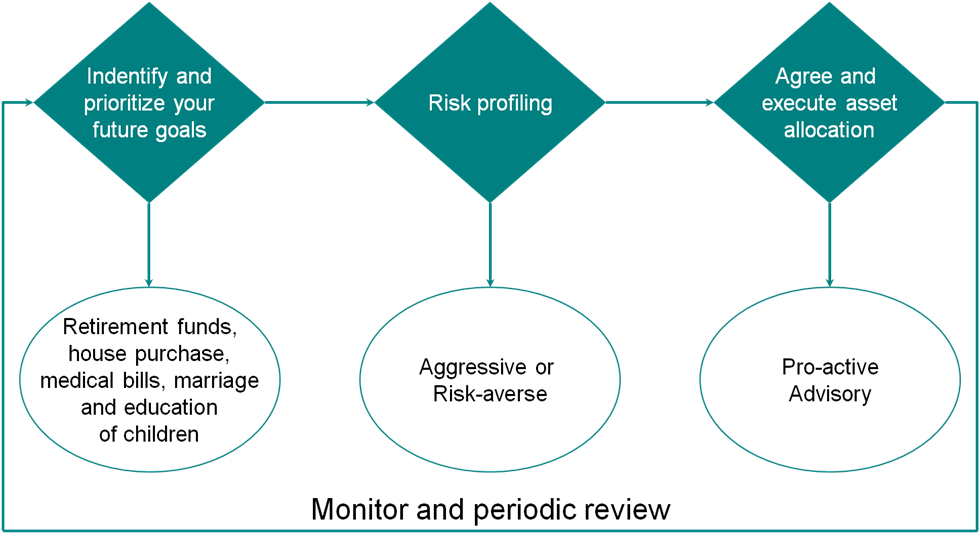

The primary task before embarking on wealth planning is identifying an investment objective which could be anything from raising a retirement corpus to planning a family holiday or perhaps marriage of the children. With a goal in mind, the time horizon required to achieve your goals can be determined. One cannot stress enough the importance of personal risk preferences – all of us have different appetite for risk and knowing how much risk, one is willing to be exposed to, is a very critical factor in achieving your financial goal.

Knowledge of your goals, timelines and risk appetite will enable a financial advisor to suggest the best asset allocation strategy. Periodic review with your financial advisor will help you further fine-tune the asset allocation. And sure enough, always keep advisors aware of major changes or life events that may alter your risk profile.

You can also visit the Goal Setting section (accessible at www.divitascapital.com/private-wealth/risk-profiler) of our website to use financial calculator to determine various quantum of savings necessary to achieve your goals. You can also make use of our risk profiler (accessible at www.divitascapital.com/private-wealth/financial-calculator) to ascertain your risk appetite.

For example, if you were to buy a house in 10 years time, the down payment for which is about Rs. 50 lakh. Assuming a 13% annual rate of return you will require an SIP of Rs. 20,000 per month or a one-time investment of Rs. 1.4 lakh.

Feel free to customize these calculations to suit your needs by changing the time period, investment amount, annual rate of return and the required amount.